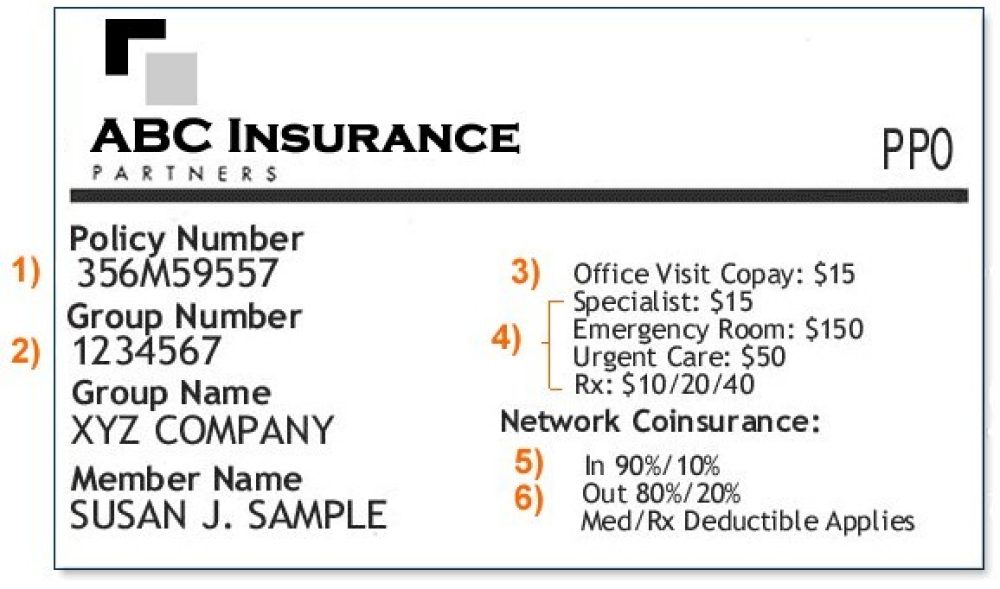

Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or “co-pay.” A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company’s network and outside the network.

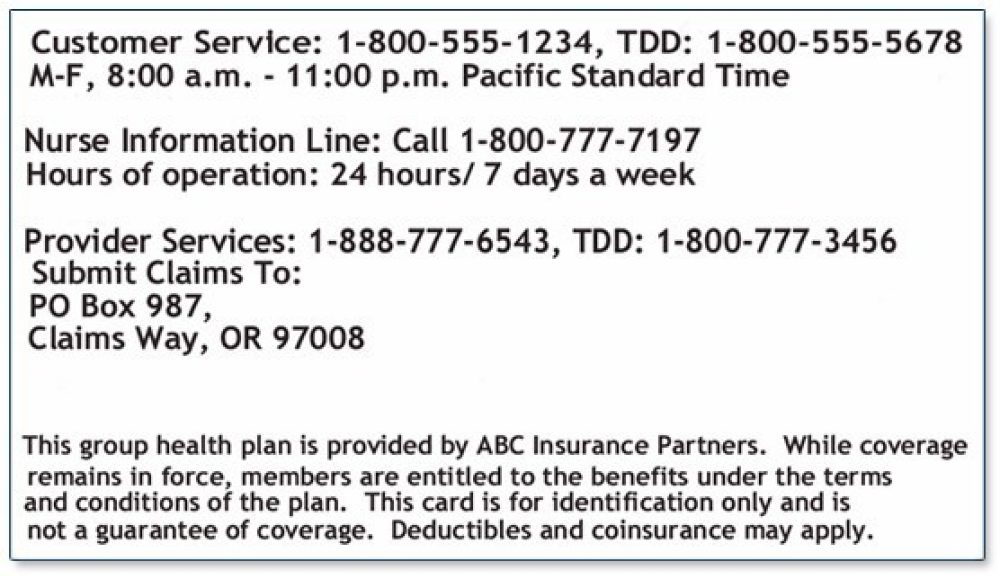

If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company (use the number on the back of your card). Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers.